Ways to Support the Fargo Public Schools Foundation

Thank you for investing in over 11,000 students and more than 1,900 staff members in Fargo Public Schools! We could not champion teachers and students without generous donors like you!

When you make a tax-deductible gift to the Fargo Public Schools Foundation, you are joining with our vision to increase opportunities for all students, by providing resources and support beyond regular educational funding. Donors make a difference in the preparation of all students as they confidently enter the future prepared to compete in an ever-changing world. Select any of the following options to donate. You are truly impacting the life of a child!

- Gifts in Honor, Celebration, or In Memory of Someone Special

- Endowments and Annual Funds

- Critical Needs Program

- Innovative Education, Literacy, and Music Grants

- Scholarship Support

Mail Donation

The Foundation administers many programs including providing grants for teachers to try new and innovative ideas in the classroom, helping students in need, to providing scholarships for graduating seniors. Your donation always goes toward the program or project you designate. Below is a printable donation form.

Please mail checks to:

Fargo Public Schools Foundation

700 7th Street S

Fargo, ND 58103

Online Donation

You can be a hero today! By giving to the Fargo Public Schools Foundation, you're unlocking the potential for young minds to shine! Your generosity will pave the way for their success, giving them the tools they need to conquer the world right now!

Take advantage of our safe, easy-to-use online donation link.

Honor a Memory

A memorial donation offers the opportunity to donate in memory of a cherished friend or family member. Upon receipt of an "in memory" donation, the Fargo Public Schools Foundation will send a card to the family, informing them of the generous donation made in memory of their loved one. Amount is not noted.

Honor the memory of someone special through the online donation link.

Give a Gift by Giving

This year, consider honoring a special someone with a donation to the Fargo Public Schools Foundation instead of traditional gifts like flowers or presents. Whether it's an alumni, loved one, or anyone who has made an impact in your life, a donation is a meaningful way to show your appreciation. Give in honor of birthdays, anniversaries, promotions, retirements, achievements, or any special occasion. When you donate, we'll send a card with a thoughtful message to the honoree, making it a gift that truly keeps on giving. Amount is not noted.

Recognize someone important through the online donation link.

Matched Giving

If your employer offers a matching gift program, please contact us to complete needed documentation or provide a copy of our tax-exempt status (issued by the IRS). You can reach us at 701-446-1041 or email us at fpsfound@fargo.k12.nd.us.

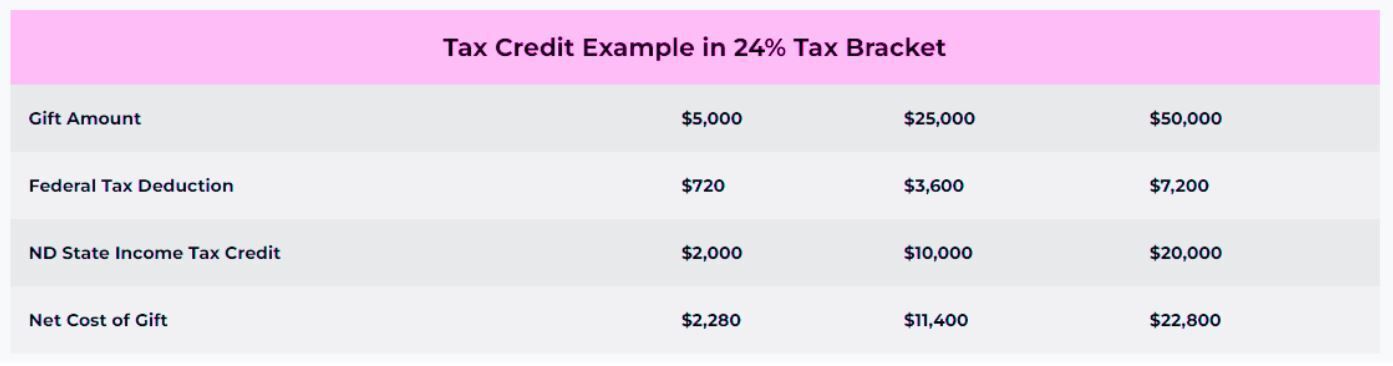

Did You Know North Dakota has a 40% Tax Credit?

North Dakota businesses, as well as individuals, may qualify for tax credits when they donate to qualified endowment funds for eligible charities in the state.

Businesses (C corporations, S corporations, estates, limited liability companies, trusts, and financial institutions) that pay ND income tax can claim a 40% tax credit for donations of any amount made to the endowment fund of a qualified charity, up to $10,000.

Individuals can claim a tax credit for donations of $5,000 or more, either as a lump sum or aggregate in one year, to a qualified North Dakota endowment. Tax credits are equivalent to 40% of the charitable deduction permitted by the IRS, up to a maximum of $10,000 per year per taxpayer or $20,000 per year per couple filing jointly.

These tax credits are permanent and do not have sunset provisions. Furthermore, any unused credits can be carried forward for up to three additional tax years.

The following table provides an estimate of the cost of charitable donations to a qualified North Dakota endowment fund for taxpayers in the 24% bracket: (For illustration purposes only. Please consult your tax advisor.)